KARACHI - Stocks fell across the board post quarter end earning announcements at KSE on Monday after key political parties demand closure of NATO supplies routes and Government consults US ties on TTP talks close following US drone strike.

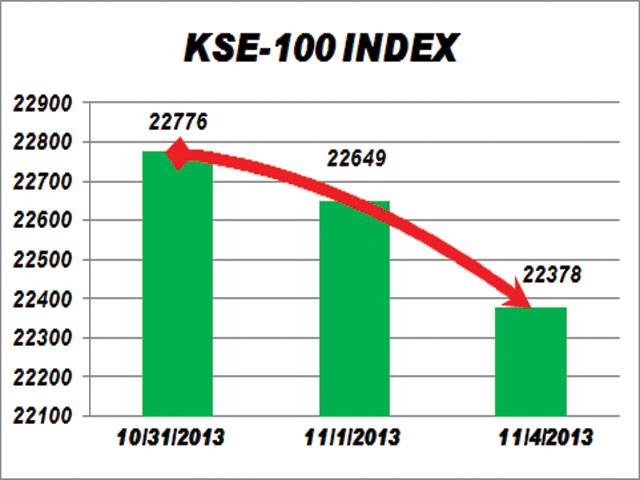

The benchmark KSE-100 share index dropped by 271.26 points or 1.20 percent and the market closed at end of day at 22377.83 points as compared to 22649.09 points. Ahsan Mehanti at Arif Habib Corp stated, World Bank delay on approval of $1b loan amid energy subsidies and dismal taxation measures, higher CPI Inflation data for Oct’13, and lower global commodities played a catalyst role in bearish sentiments.

The KSE-All share index also declined by 214.82 points or 1.30 percent at the end of the day and closed at 16306.27 points, KSE-30 share also fell 216.10 points or 1.25 percent and closed at 17022.16 while KMI-30 index also showed negative trend and fell by 465.86 points or 1.21 percent and closed at 37924.70 points. High and Low were 22649.09 and 22199.46 respectively.

In expectation of rising tension between Pakistan and US after the drone attach over the weekend investors preferred to trim their positions. Market players feel if this tension continues it will affect Pakistan balance of payment and local currency. Index fell by 271 points with volume in rupee terms stood at Rs.3.5b. BAFL led the volume with 10m shares exchanged hands followed by JSCL with 9m shares and PTC with 9m shares, said market analysts.

Topline Research said relations with US, which were boosted after Sharif’s recent visit to Washington, are again going through testing time after the recent drone strike. This attack resulted in the death of Pakistan Taliban leader, few days ahead of commencement of peace talks. The statements from Interior Minister and some opposition leaders forced newly elected Sharif government to call an emergency cabinet meeting to discuss this tense situation. Parliament session is also scheduled for today where heated debate on US drone attacks and other related matters will come in focus.

Considering the fact that situation is yet not clear as to what strategy the Sharif government will make vis-à-vis Pakistan’s relationship with US is concerned, the investors in equity market will remain disturbed. Pakistan market will take these developments negatively unless the government clarifies its stance on NATO supplies and related issues. We maintain our range bound stance for Pakistan market as mentioned in our note titled ‘Pakistan Strategy: Liquidity to flow to bonds’ dated October 1, 2013.

Saturday, April 20, 2024

KSE sheds 271 points on higher CPI Inflation

Volcanic eruptions in Indonesia affect thousands of passengers

10:30 AM | April 20, 2024

Freedom Flotilla prepares for humanitarian aid delivery to Gaza

9:14 AM | April 20, 2024

Sindh govt signs lease land accord for Dhabeji SEZ

April 20, 2024

Health activists for ban on small cigarette packs

April 20, 2024

Policitising Tragedy

April 20, 2024

Tehran to Rafah

April 20, 2024

A New Leaf

April 20, 2024

A Tense Neighbourhood

April 19, 2024

Dubai Underwater

April 19, 2024

Dangers of Deepfakes

April 20, 2024

Feudalism

April 20, 2024

Kite tragedy

April 19, 2024

Discipline dilemma

April 19, 2024

Urgent plea

April 19, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024