LAHORE – The fertilizer industry has remained the best performer at the capital market, as it has surpassed all sectors in terms of paying ‘return on equity’ to its shareholders.

The urea manufacturers, who have always been managing to avail smooth gas supply at subsidized rates throughout the year, have paid return on equity by 94.23 per cent, banking sector 17.3 percent and cement industry 3.86 per cent in 2010-11, capital market experts observed.

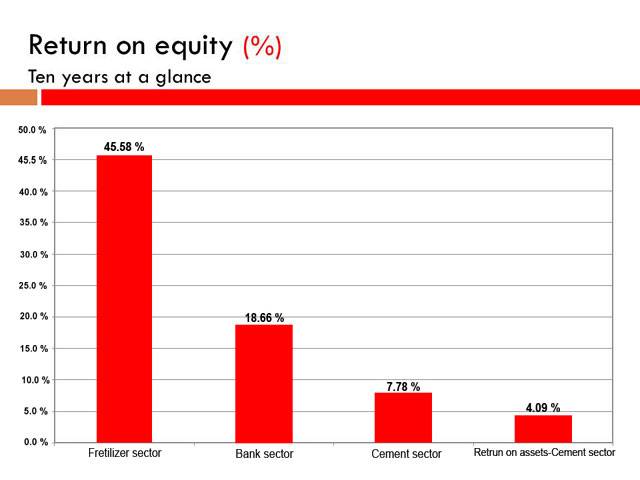

Likewise during the last decade, the same fertilizer industry showed enormous growth and remained the first with 45.58 per cent return on equity, even banks are far behind, paying 18.66 per cent return, experts said and added that cement sector returned back to shareholders the profit of just 7.78 percent in said period.

Experts said that profits of all big players in fertilizer industry almost doubled during the last calendar year and the main factor behind this increase in earnings has been the frequent increase in the prices of fertilisers.

Engro profits increased by 49 per cent, Fauji Fertilizer Corporation (FFC) 102 per cent, Fauji Fertilizer Bin Qasim Limited (FFBL) 153 per cent, Pak Arab 90 per cent and Fatima Fertiliser profit also jumped phenomenally during the first nine months of current calendar year compared to corresponding period last year.

Industry experts observed that prices of urea stood at Rs790 per bag in January 2011 that had shot up to Rs1,800 per bag now. They said that urea companies were also getting subsidy on gas but still selling fertiliser at higher rates. “The high prices of fertiliser will also affect the prices of wheat causing hike in prices of all food items,” they said.

According to official break up, fertiliser companies had earned Rs22.57 billion profit before tax during January-September 2010. But their profit after tax rose to Rs44.72 billion during the period of January-September 2011 even in gas curtailment regime.

Engro profit stood at Rs5.33 billion, FFC Rs20.7 billion, FFBL Rs10.89 billion, Pak Arab Rs4.94 billion and Fatima Rs2.42 billion.

It is amazing to note that the return on equity of the fertilizer sector was 31.26 per cent in 2001-02, which jumped to 41.39 per cent in 2007-08, 53.12 per cent in 2008-09, 63.43 per cent in 2009-10 and 94.23 per cent in 2010-11. In the same way the return on equity of banking sector was 9.64 per cent in 2001-02 that peaked to 29.30 per cent in 2002-03 and 2006-07. It was 19.06 per cent in 2007-08, 15.83 per cent in 2008-09 and 17.30 percent in 2009-10.

The cement sector’s return on equity in 2001-02 was 8.37 per cent, it was 17.13 per cent in 2003-04, 19.67 per cent in 2004-05 and 18.95 per cent in 2006-07. The cement industry’s return on equity dipped to 0.38 per cent in 2009-10 and was 3.86 percent in 2010-11 about half what it was at the start of the century.

According to the average ten years data of the KSE, cement sector’s average return on equity for past ten years have gone down to 7.78 per cent against 45.58 per cent of fertilizer sector and 18.66 per cent of the banking sector during the same period. Cement manufacturers claimed that figures indicate the worst condition of the cement industry, which can earn more if it deposits its money in banks, as they offer up to 12 interests.

Industry experts said domestic cement despatches during the eight months of current financial year is 20.451 million tons showing a growth of 7.37 per cent and exports despatches declined by 5.57 per cent compared with corresponding period. Export to Afghanistan and India grew by 6.72 per cent and 39.48 per cent while exports by sea declined by 17.33 per cent compared with corresponding period. The 84 per cent of the cement capacity is located in the northern part of the country, where the industry posted a modest gain of 5.89 per cent in domestic market and exports declined by 1.38 per cent.

Saturday, April 20, 2024

Fertilizer sector best performer at capital market

5:19 PM | April 19, 2024

Pak economy improving, funds will be provided on request: IMF

9:57 PM | April 19, 2024

Minister advocates for IT growth with public-private collaboration

9:57 PM | April 19, 2024

Judges' letter: IHC seeks suggestions from all judges

9:55 PM | April 19, 2024

Formula 1 returns to China for Round 5

9:05 PM | April 19, 2024

Germany head coach Julian Nagelsmann extends contract till 2026 World Cup

9:00 PM | April 19, 2024

A Tense Neighbourhood

April 19, 2024

Dubai Underwater

April 19, 2024

X Debate Continues

April 19, 2024

Hepatitis Challenge

April 18, 2024

IMF Predictions

April 18, 2024

Kite tragedy

April 19, 2024

Discipline dilemma

April 19, 2024

Urgent plea

April 19, 2024

Justice denied

April 18, 2024

AI dilemmas unveiled

April 18, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024