KARACHI - Pakistan stocks closed higher ahead of year end close on strong valuations.

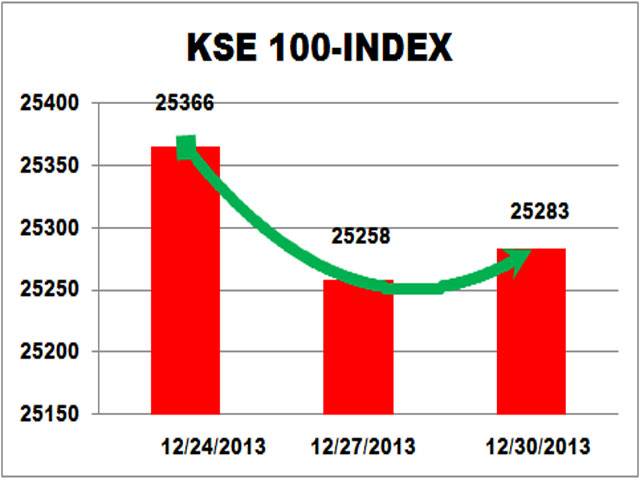

The Karachi stock market benchmark KSE-100 share index added 25.91 points or 0.10 percent to end the session at 25283.96 points compared to 25258.05 points of the last working day on Friday.

Analyst at Arif Habib, Ahsan Mehanti said trade remained high led by second and third tier stocks in cement and textile sectors on higher local cement prices and expected rise in textile sector exports post GSP plus status. Selected oil and banking stocks played a catalyst role in bullish activity despite rising political uncertainty amid protests, he added.

KSE-Allshare index up by 18 points or 0.10 percent to finish the day at 18667.22 points, KSE-30 share index grew by 19.19 points or 0.10 percent to stop the day at 18864.31 points while KMI-30 share index off by 15.17 points or 0.04 percent to close the day at 42542.62 points. On the first day of trading week, KSE traded 194.459 million shares after opening at 199.212 million shares and the value of traded shares was reduced to Rs 5.850 billion from Rs 7.748 billion. Bourse capitalisation settled at Rs 6.057 trillion compared to Rs 6.051 trillion of a day earlier.

Trading took place in 378 companies where gainers outnumbered the losers 232 to 127 while the value of 19 stocks remained intact. Nestle Pak was the biggest loser of the day decreased by Rs 300.01 to Rs 7600 followed by Unilever Foods down by Rs 200 to Rs 9300. Bata (Pak) and Indus DyiengXD were the top gainers of the day increased by Rs 110.06 to Rs 2760.06 and Rs 51 to Rs 1170.

Equity dealer at Topline, Asad Siddiqui said active participation was seen in cement stocks on the back of potential increase in cement prices. Textile stocks also remained high on investors’ preference list as GPS+ status will become effective from January 1st. On the flip side, due to unannounced gas curtailment fertilizer stocks saw profit taking, on the back of news regarding reviewing ICH (international clearing house) status led to profit taking in PTC.

Top 3 volume leaders were MLCF, ANL and FCCL with 26.2m, 23.6 and 21.5m shares, respectively, making up for more than 36pc of total market’s volume.

Active list was topped by Maple Leaf Cement with 26.165 million shares as it closed at Rs 27.38 after opening at Rs 26.69. It was followed by Azgard Nine with 23.5181 million shares up by Re 0.47 to Rs 7.23, Fauj Cement with 21.543 million shares extended by Re 0.51 to Rs 16.02, PTCLA with 9.824 million shares off by Rs 1.14 to Rs 28.21 and Flying Cement with 7.114 million shares higher by Re 0.47 to Rs 6.41.

Friday, April 19, 2024

KSE gains 26pts on textile export hopes

20pc Discos employees involved in power theft: Minister

April 19, 2024

Five govt officials shot dead in D I Khan

April 19, 2024

Parvez Elahi’s indictment delayed again in two cases

April 19, 2024

SC suspends ECP’s re-polling order in PP-51

April 19, 2024

Hepatitis Challenge

April 18, 2024

IMF Predictions

April 18, 2024

Wheat War

April 18, 2024

Rail Revival

April 17, 2024

Addressing Climate Change

April 17, 2024

Justice denied

April 18, 2024

AI dilemmas unveiled

April 18, 2024

Tax tangle

April 18, 2024

Workforce inequality

April 17, 2024

New partnerships

April 17, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024