ISLAMABAD - The Ministry of Finance Saturday clarified that Pakistan would not default as there would be a major economic turnaround with political stability likely to emerge soon.

A spokesman for the Ministry of Finance on Saturday said Pakistan's economy was moving firmly in the right direction to achieve stability and sustainable growth under a rigorous reforms policy.

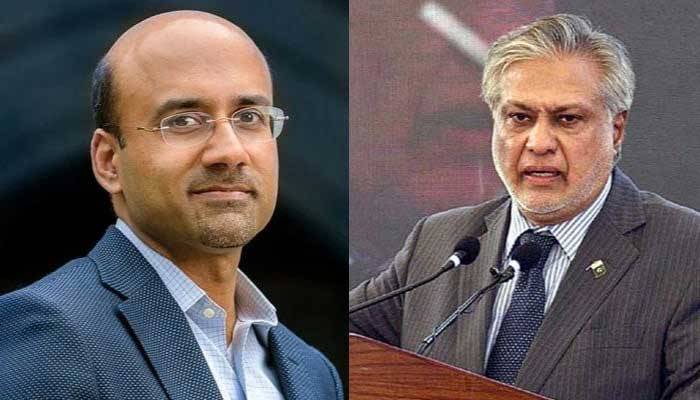

“... the country is surviving economically and will continue to survive. . . what Pakistan has done is decisive and courageous: we will continue to walk the road to reforms to stabilize our economy and in the course of time to steer it toward the path of sustainable growth,” he said. Refuting the negative remarks uttered by an economist Atif Mian about Pakistan’s economic policy and its comparison with Ghana and Sri Lanka, the spokesman termed it a “misplaced criticism made from a purely theoretical point of view.”

Responding to a tweet of the economist in which he criticised Pakistan’s economic policy and suggested Pakistan take decisive actions, aggressively restructure and take courageous actions; the spokesman said “This is a veiled suggestion to declare default.”

He said “The gentleman has no idea how practical economics operates in practice. His comparison with Ghana and Sri Lanka, is also misplaced given the incomparably small size of their economies and populations relative to Pakistan.”

Fundamentally, the spokesman said the economist did not care to analyse the structure of Pakistan’s debt which had less than a 10% share in commercial bonds/sukuks, with the next maturity falling due in April 2024.“The rest of the debt is owed to the multilateral and bilateral creditors. Both these classes of creditors are engaged with Pakistan and none has assessed that Pakistan should default. The spokesman regretted that the author had completely ignored the deep-rooted reforms Pakistan had undertaken during the last nine months, including market exchange rate, and interest rate adjustments. mid-year taxation to improve fiscal position, imposition of levy on petroleum products and non-monetization of fiscal deficit.

“All these actions were undertaken under an IMF programme which was unprecedented as never in the country’s history such front-loaded conditionality was imposed. However, we accomplished it through heroic efforts.”

He said “It is unfortunate that despite such actions, the staff level agreement (SLA) has still not been reached delaying the release of the 90 review tranche. The country is surviving economically and will continue to survive.”

The spokesman said what Pakistan had done was “decisive and courageous: we would continue to walk the road to reforms to stabilize our economy and in the course of time to steer it toward the path of sustainable growth.” He said the comparison of the nominal exchange rate was also unwarranted, adding “Pakistan’s real exchange rate is currently estimated to be 15% undervalued. The nominal rate is the result of speculation, market manipulation and general distraught from political instability.”

The spokesman explained the undervalued exchange rate was reflective of the fact that underlying fundamentals were improving. “Pakistan has historically sold petroleum products at significantly lower prices than regional countries. With the petroleum levy of Rs.50 achieved, this doesn’t involve any subsidy from the government.”

He said it would be unwise to levy additional tax on consumers on top of prices that had doubled in less than a year, especially when they were facing rising inflation. “The author has cited this as an example of nonsensical policies,” the spokesman said, declaring it “simply a misplaced example.”

He said Pakistan’s economy had suffered because of international shocks of COVID, the Russia-Ukraine war and devastating floods of last summer. “The challenges that resulted from an overly heated economy, bequeathed to us in April 2022, and the breach of IMF conditionality on the eve of the departure of the PTI government, have been overcome by the present government.” The spokesman said the current account deficit; the primary indicator of the balance of payments imbalance, had firmly been brought down from a high of $17.5 billion to around $3.2 billion. “This achievement is a reflection of bringing the economy to within its latent strengths and not on borrowed resources.”